It wasn’t too long ago that sending documents by post, printing, wet signing and manually processing finance applications was acceptable – not anymore.

In post-pandemic Australia, consumers not only expect timely, streamlined financial services, but will go elsewhere if not immediately offered as such.

Nodifi takes a look at changing client needs and expectations and how brokers can align themselves in an opportune way.

Online services overview

Interestingly, but unsurprisingly, the past two years have seen Australians spend more time online. In 2020 alone, Australians aged 16-64 spent an average 32 minutes longer online each day compared with 2019, an increase of 10%. However, the time spent watching TV only rose by 15 minutes per day over the same year.

Furthermore, in 2021, over two-thirds of Australians aged 55-64 regularly went online for their purchases showing the demographic is not as un-tech savvy as some may perceive them.

Comparing Australians online in 2018 with the present shows increased reliance on online services.

Average daily time spent online

- 2018: 5h 34m

- 2021: 6h 13m

Increase: 11.7%

Social media

- 2018: 69% of population active social media users

- 2021: 82.7% of population active social media users

Time per day users are active on social media

- 2018: 1h 39m

- 2021: 1h 57m

Increase: 18.2%

Online purchasing

- 2018: 59% of Australians made a purchase online

- 2021: 75% of Australians made a purchase online

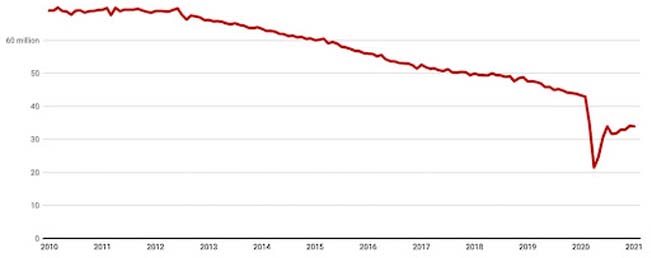

The decline in cash purchases is also worth pointing out. The graph below shows ATM cash withdrawals using debit cards per data from the Reserve Bank of Australia.

The bottomline is that Australians are turning to online resources more often and more willingly as they have access to better performing apps. Retail deliveries, click and collect and food delivery services are some examples.

The effect on brokers

Of course it’s not just retail stores, streaming services and food delivery apps that are developing ways to meet consumer expectations.

As The Adviser highlighted, a recent survey found that 75% of respondents thought applying for a home loan was a “slow and tedious process”. Of the first home buying age range, 18-34, 83% agreed with the above two adjectives.

Further data shows that almost 50% of Australians are frustrated by the paperwork entangled with home loans.

Brokers of all categories who can offer streamlined, smooth and above all else, fast processes, have gained increasing market share.

Data from Nodifi has revealed that partners who transitioned from a focus on prompting customers to phone in for their enquiries to offering online forms with application integration saw significant increases. This was especially evident towards the end of lockdowns.

The effect from brokers

The knock-on effect of changing client expectations is that brokers are opting for lenders and origination platforms that offer the same advantages their clients are seeking.

An example is digital signatures. HelloSign and Docusign are two such platforms that offer legally binding documents that can be signed digitally – and instantly. When a lender offers digitally signable documents, it can be a real advantage for a broker wanting to keep things fast and simple for clients.

Data from an Adobe survey showed that 76% of respondents in the APAC countries, which Australia is part of, said they e-signed more documents in the last six months of 2020 compared to late 2019 and early 2020.

53% of respondents said they e-signed for the first time in 2020. Millennials had the highest adoption rate at 61%.

Nodifi has found increasing numbers of partners opting for and commending lenders who offer smooth online application assessment and settlement processes.

According to Nodifi’s Chief Technology Officer, Dave Longbottom, finance seekers want more fast automation and less human interaction.

“Clients will be happy when applications happen via an almost entirely automated process, within a few taps of a phone screen.

“Tasking clients with minimal steps in as smooth a way as possible can offer a real competitive edge.”

Transitioning to meet client expectations can be challenging

Allowing clients to complete applications in as minimal steps as possible while responsible lending and compliance regulations are adhered to can be a pain point.

This is something key to both broker and lender future development.

Below are some simple ways brokers are offering faster processing times and simpler steps for their clients while maintaining accuracy.

Digital documents and e-signing

As mentioned, HelloSign and Docusign offer these solutions and are accepted in Australia. From the client’s end, signable documents are mobile friendly and prompt for signatures where needed.

In other words, should they wish, a client can scroll down to the area needing a signature, adopt a predetermined signature, agree and sign in a few taps, in a few seconds.

Plans start at $14/month.

Web forms

This means a website visitor is able to enter information on a website. The information is then stored and processed behind the scenes.

These can include entire application forms, allowing the user to add all necessary details from their phone in their own time. The website custodian then assesses the application and submits it to a lender, only contacting the applicant if or when needed, usually via email.

Identification

Many brokers allow clients to simply take photos of ID and send those through via email, but there is technology available to help too.

The Australian Government’s Digital Identity while catering to government services, is an example of progress being made.

While most lenders at this point in time don’t offer a digital ID, progress to allow consumers to simply agree to digital ID integration is on the horizon.

It means a simple checkbox allowing applicants to integrate their digital ID at the tap of a phone screen, rather than photos with shadows and blurs and emails.

Loan origination platforms

A good loan origination platform allows brokers to access all they need to satisfy client demands and expectations online in a timely manner.

These platforms offer cloud-based services and the ability to enter details and documentation, workshop deals, submit to matching lenders and settle loans all online. The end client is left with an approval and settlement all from their phone, getting close to Dave’s vision above.

A challenge and an opportunity for brokers

As many home loan applicants know, information requests can get frustrating. For example, when applying for finance through their own bank, they are often prompted for information that the bank ‘should know’ like spending habits.

Further frustrations arise when a client’s application is handballed to different departments, some of which aren’t even in the same country, let alone the same building.

A broker can dramatically improve on this.

Using the technology listed above with the best productivity apps out there, it’s not difficult to A: offer a better experience than some larger organisations can and B: increase NPS feedback and referred business.