We tap into our 40+ lender panel and award winning team of experts to bring you up to speed on the latest new and used car buyer demographics.

Soaring demand, stock issues and renewed enthusiasm for domestic travel proved a scenic route in Nodifi’s numbers, reflecting Australian car buying habits numbers over the last 12 months.

FY 21/22 Top Sellers in Brief

FY 21/22 takeaways

- Despite stock delivery wait times, 2021 models reported large numbers

- The Mitsubishi Triton proved popular

- In terms of volume, married/de facto males (aged 18-39) with dependants in Victoria reported the highest numbers

- Hybrid vehicles, such as the Mitsubishi Outlander, are gaining traction

- Utes and SUVs are undoubtedly the most popular choices across all demographics

Specific Demographics

Note: all categories listed in order highest recorded numbers

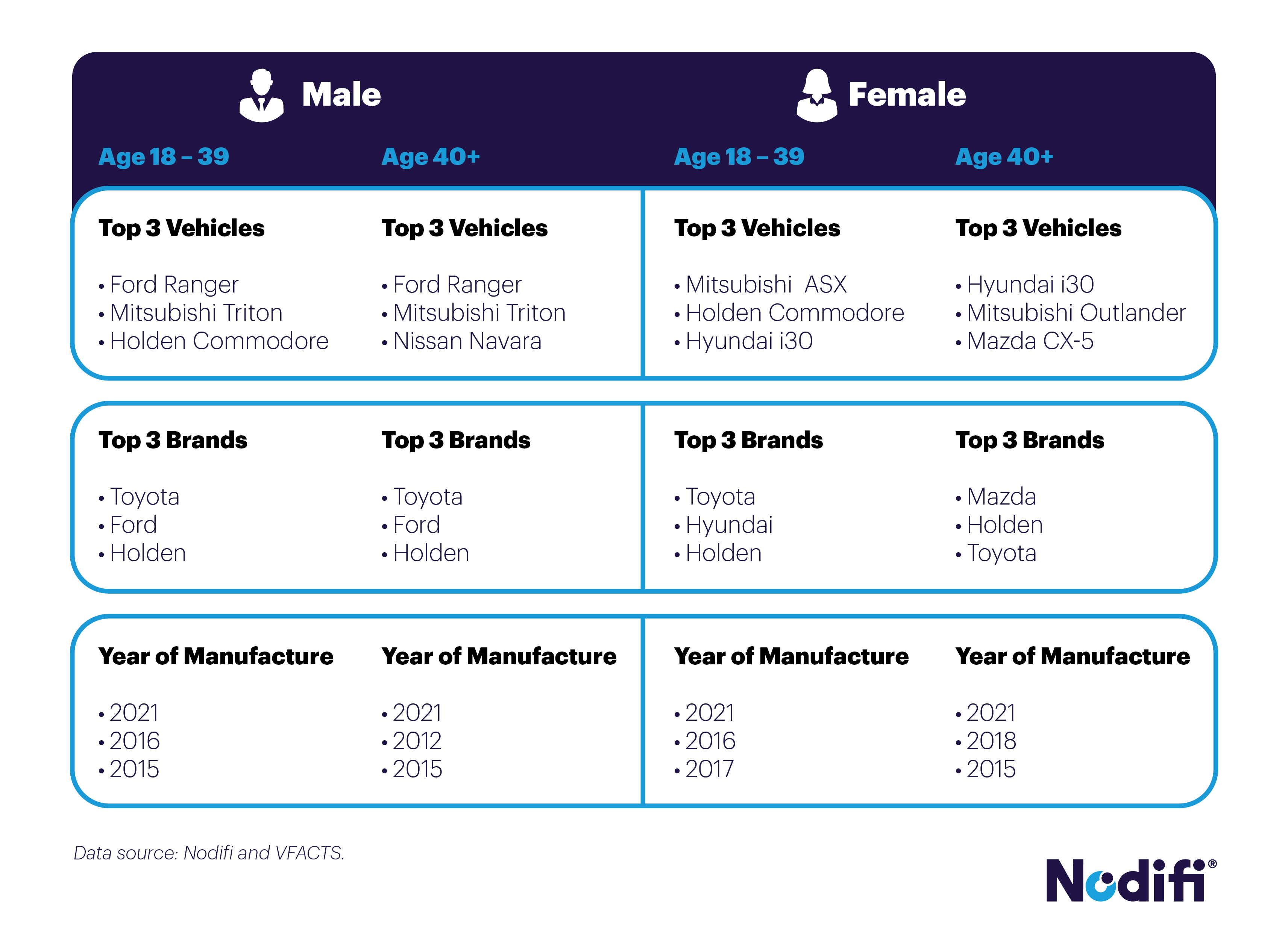

Singles

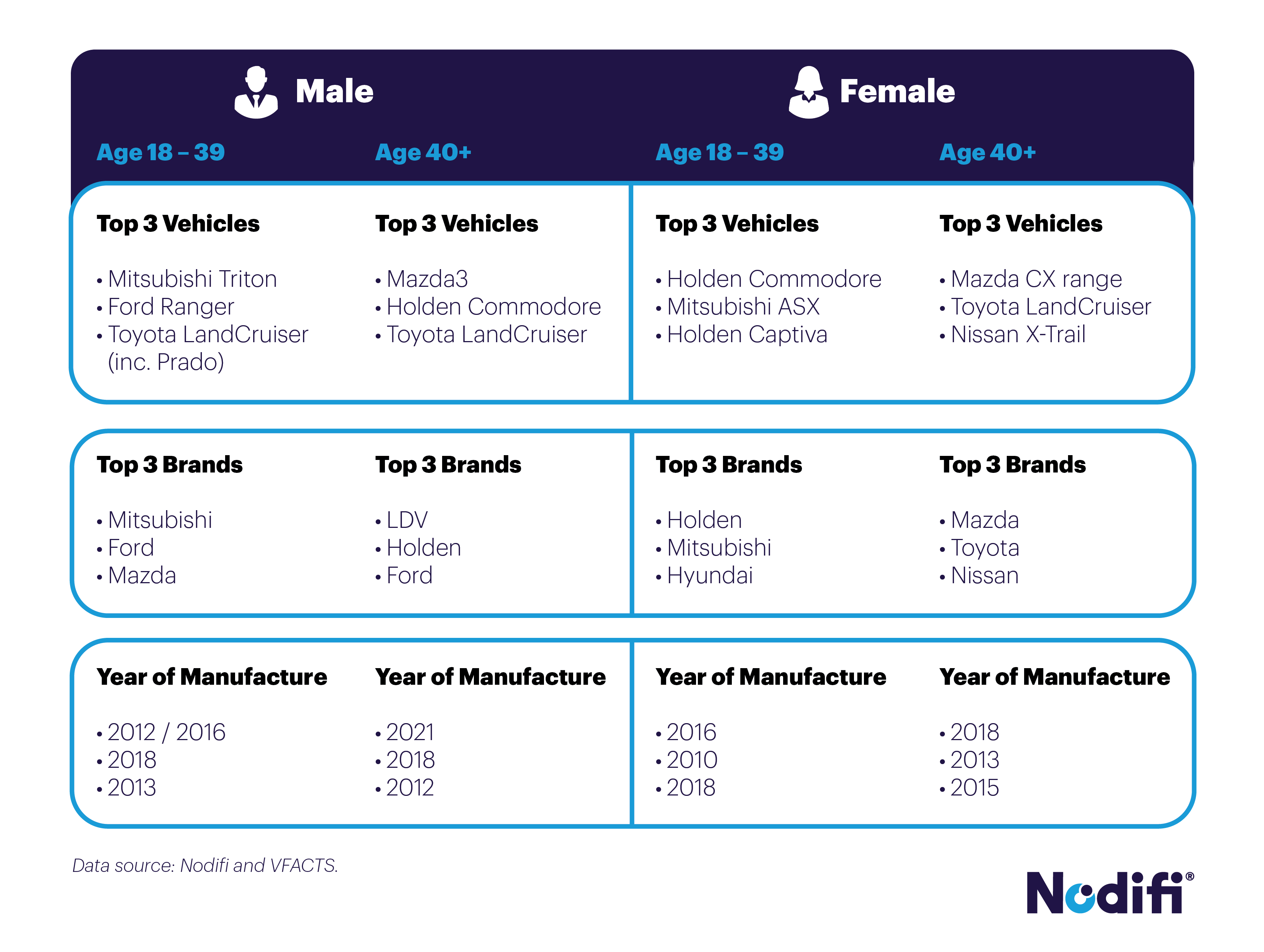

Singles with Dependents

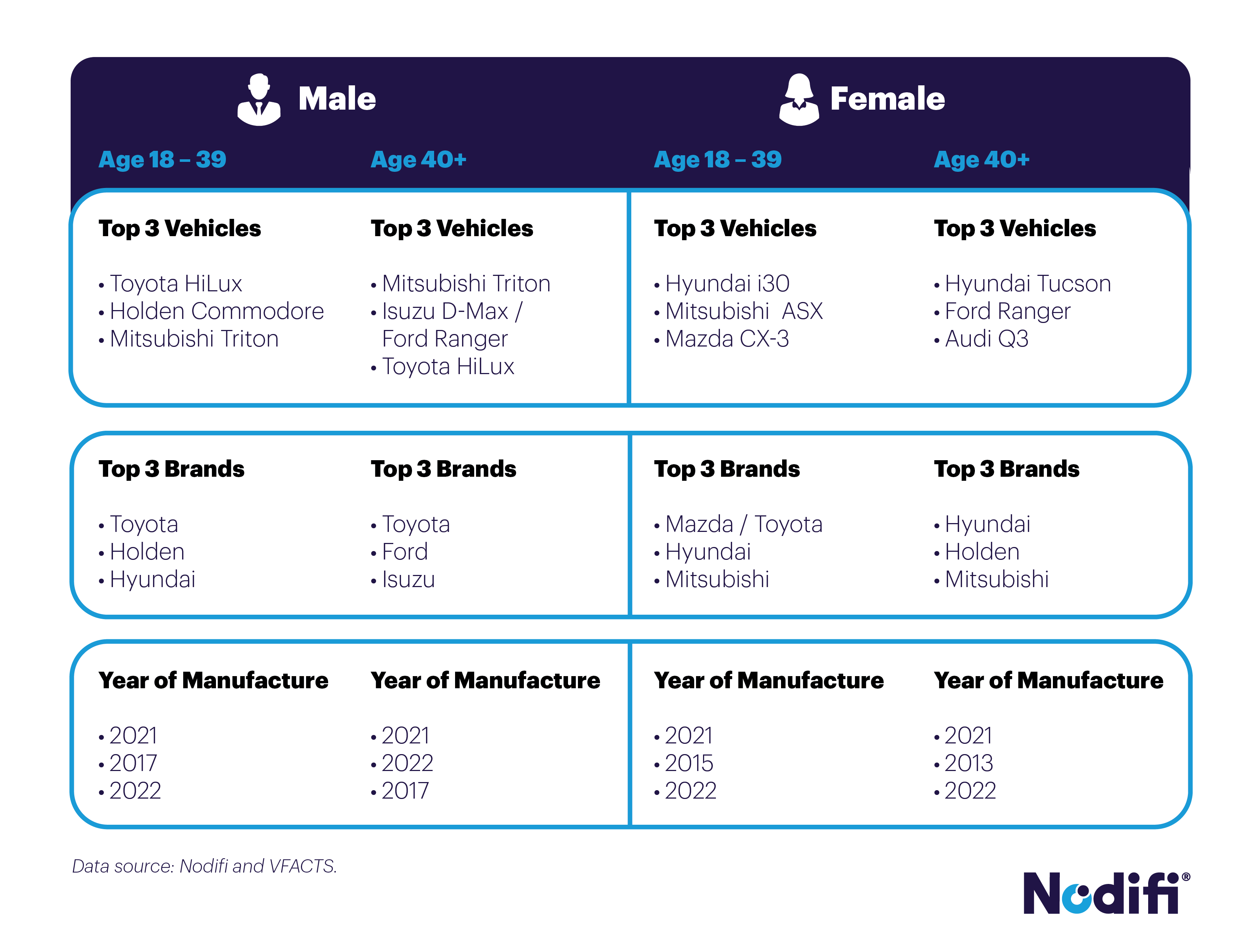

Married or DeFacto without Dependants

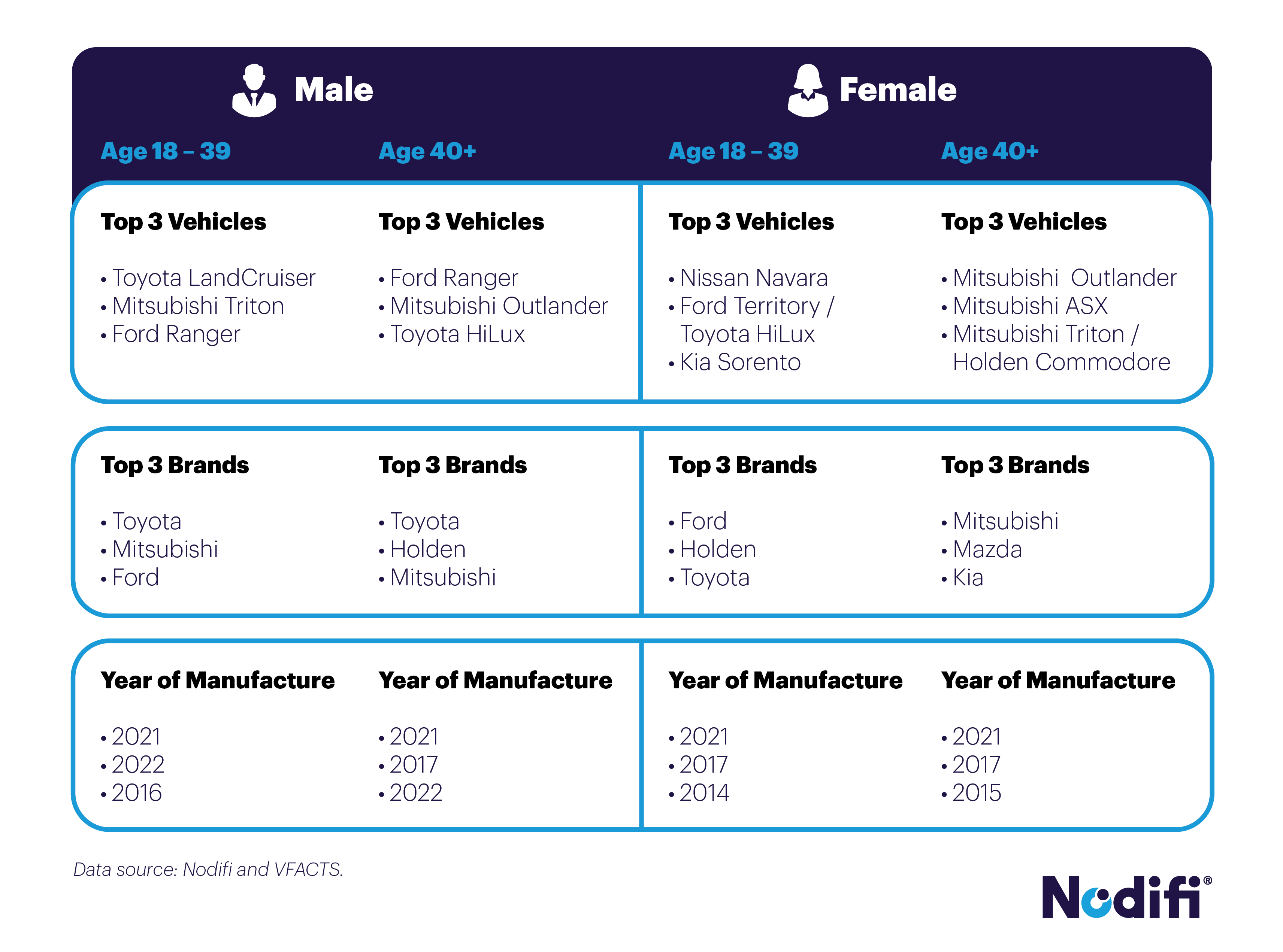

Married or DeFacto with Dependants

Top Sellers (by state / territory)

Additional Statistics

Highest-selling year of manufacture (total)

- 2021

- 2016

- 2015

Most borrowed (volume)

Males (married / de facto) with dependants in VIC (ages 18 – 39)

Top selling new vehicles (2021 – 2022 year of manufacture)

- Ford Ranger

- Isuzu D-Max

- Mitsubishi Triton

To summarise

Despite the ups and downs of stock shortages and the ups and ups of used car prices, Australians aren’t shying away from securing their next vehicles.

Furthermore, in typical Aussie fashion, utes, SUVs and other vehicles that allow for cargo and passenger space with a few road trips in mind are still seeing strong demand despite fuel prices woes.

The popularity of the Mitsubishi Triton in the numbers above hints that long wait times and high prices on used examples are seeing some buyers opt away from hall-of-famers like the Ford Ranger and Toyota HiLux.

At the time of writing, Price My Car’s New Car Delivery Date Estimator pegs a new Ranger at a massive 161 days and a new HiLux at 151 days until they arrive in a buyer’s driveway.

Looking forward, with the introduction of Polestar vehicles in Australia and Tesla and other EV models somewhat filing orders (albeit slowly), we’ll likely see this segment make more presence.

Or learn more about Nodifi by speaking with our team today on 1300 989 493.