Sedans once ruled Australian roads. They represented the top two best selling vehicle spots in the country for decades. Ford and Holden sold sedans in massive numbers. But the good times weren’t to last.

Reflecting on our look at car financing in Australia, Nodifi dives into the changing consumer trends affecting vehicle sales and takes a look at where the industry is headed.

SUVs and sedans: Rise and demise

One of the most prominent and noticeable changes to Australian car preferences is our love affair with SUVs and utes.

Back in the 1980s, these were some of our top selling vehicles

- Holden Commodore

- Ford Falcon

- Mitsubishi Magna

- Ford Laser

SUVs didn’t make a blip on the radar but by the late ‘90s, things were starting to change. In early 2000, the Honda CR-V made the 10th best-selling vehicle and was the only non-passenger car in the top 10.

Today, that’s not the case. In fact, in January, 2021 for the first time since 1948, Holden recorded ZERO new vehicle sales due GM’s decision to cease operations post 2020.

In December, 2020, SUVs made up 51.7% of all new vehicle sales in Australia. Passenger cars scored just 20.9%.

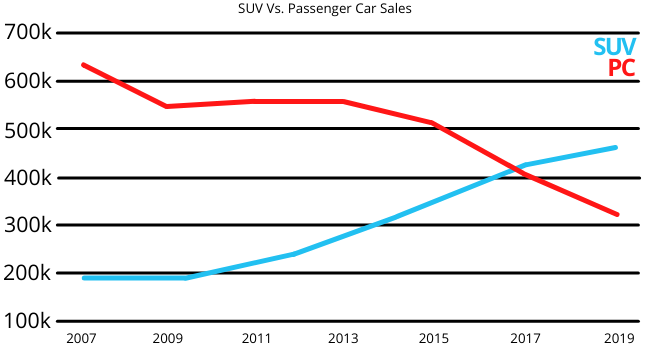

SUVs made huge gains over passenger sedans from around 2007 to 2019

In numbers

2007

SUV sales: 198,176

Passenger sedan sales: 637,019

2019

SUV sales: 483,604

Passenger sedan sales: 315,671

Why?

Most experts point to a few reasons as to why SUVs are seeing so many sales.

Options

The range of SUV variants is huge. FWD, RWD, AWD, 4WD, compact, midsize, full size and crossover, plus all the trim levels including sports, off-road and luxury variants.

Fuel Efficiency

Consumers demand excellent fuel efficiency. Today, SUVs are no longer the gas guzzlers they used to be. Take Australia’s best selling ute, the Toyota HiLux, for example:

- 2001 HiLux: 12.5 L/100km

- 2010 HiLux: 11.8 L/100km

- 2021 HiLux: 10.9 L/100km

But they’ve also put on weight

- 2001 HiLux (SR5): 1405kg

- 2010 HiLux (SR5): 1730kg

- 2021 HiLux (SR5): 2055kg

Payload

Cargo and passenger space have also become a huge priority. Consumers are focusing on how much they can fit in a vehicle, i.e., the practicality.

For example, a Holden VK Commodore, the best selling family car of the mid-1980s, has a wheelbase of 266.8 cm. Compare that to a traditionally ‘small car’, the Toyota Corolla – the 2021 model has a wheel base of 270 cm.

How are people selecting cars?

The days of the ‘hard and pushy’ face-to-face sell in car showrooms are becoming a thing of the past.

According to a recent Brandwatch survey of 2,700 people, vehicle quality is three times more important than friendly customer service.

Further data shows that after deciding to purchase a car, 60% of car shoppers (new and used) are open to multiple models. 78% of shoppers use third-party sites to research vehicles online while less than half that (36%) look at OEM sites.

But what are consumers actually looking for online?

Top five online activities conducted online by car shoppers

- Price research: 71%

- Finding listed examples for sale: 68%

- Comparing models and trim levels: 64%

- Finding current vehicle value: 63%

- Dealer details (location, etc.): 46%

What about actually buying cars online?

Research, price negotiating, registration and stamp duty are offered online, as is car-transporting. So are consumers buying cars online?

According to a recent study by Frost & Sullivan, around 825,000 new vehicles were sold online globally in 2019. That number is expected to rise to 6 million vehicles by 2025.

Amazingly (but not surprisingly), 66% of Tesla’s sales are made online – that’s full payment of vehicles. It makes sense as to why Elon Musk has been flirting with the idea of accepting Bitcoin as payment one day.

Where are we headed?

Personalisation. With the fast and streamlined processes achievable thanks to digitisation, the ability for consumers to tailor their selections themselves is becoming a must. The cheapest is not necessarily the best anymore.

Just ask the 30 million YouTube Premium users and 150 million Amazon Prime members who enjoy a personalised digital service.

Car buyers have had the ability to choose trim, engines, wheels, colours and more for years but the whole process from initial research to handing over keys is moving to personalisation.

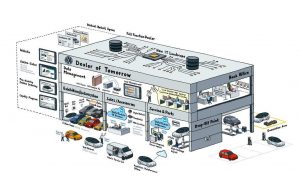

Last year, auto giant Volkswagen, announced their plans for the ‘dealership of tomorrow’ which provides VW customers with a unique ID, ensuring seamless targeted online sales and finance, servicing and 24-hour support / troubleshooting.

VW says online sales are to be massively expanded ‘with five new sales and service formats such as city showrooms or pop-up stores are to be added’. Furthermore, vehicles will be kept up-to-date by over-the-air software updates and customers will also be able to access services from the Volkswagen ‘We digital’ ecosystem such as We Park, We Deliver or We Connect. Soon, ‘We Share’, the car sharing offering from Volkswagen, will be offered too.

The move aims to push the ‘once a VW driver, always a VW driver’ idea.

(VW’s ‘Dealer of Tomorrow’ concept. Source: volkswagen-newsroom.com)

At the end of the day

The auto industry isn’t too different from other industries. Advances in technology mean improvements across the board. A smoother and faster customer experience that allows individuals to customise their decisions – ultimately resulting in more sales.