Over a strong double-shot oat milk latte: Amy talks us through consumer asset finance in 2021’s changing landscape and keeping those NPS numbers sky high.

With her six years of experience in building rapport and friendships in the finance industry, Amy brings her contagious personality to our partners, their clients and the whole team.

Here are her insights on the consumer asset finance space and the happy clients within it.

Key Takeaways

- In today’s finance world, the client is more protected

- Brokers are likely to become more necessary in the future

- Commercial clients looking for consumer products can be faced with excessive documentation compared to commercial products

- ‘Smile’ on the phone for high a NPS

- Also, treat every client, no matter their circumstances, as a prime client and let them get to know you too

1: Asset finance is not the same as it was several years ago. How and why are things different today compared to when you saw your first deal settle?

I was lucky to come into the industry just as the changes came in and wasn’t affected personally by them.

It was interesting to see how a client’s rate was determined a few years ago to how it is now, the consumer is a lot more protected and their best interest is now highly valued.

That’s a base for delivering exceptional service and building trust.

2: Based on that past and present you described, where do you think the industry is headed?

I think that the industry is headed where it is going to become more difficult to be able to get finance which is why a broker is so crucial to the consumer.

Clients have that reassurance with brokers that their whole profile can be assessed and a suitable lender can be found based on multiple reasons while their credit file is being protected.

This is something that I always explain to clients.

It’s easy to just apply at a bank or credit union, especially online, but that can typically result in a higher chance of decline (compared to using a broker) and that impacts a credit file.

3: Is it purely rates that are the most important things for clients these days?

I have found that clients are now looking for low repayments, low fees, in addition to having a low rate. The consumer seems to be more conscious now with all these factors rather than just on rate alone.

4: As a consumer asset finance guru, what are the key differences between consumer and commercial asset finance from a broker’s perspective?

Proof of income is the biggest one that comes to mind and it’s the most challenging task we have.

If you have a commercial client looking to get a consumer product financed, the documentation required is rather excessive compared to if you were financing a commercial product. Income in the consumer space isn’t as straightforward as commercial. Lenders want to see multiple different documents to ensure income is as stated.

The other thing is options. We have a lot more options in the consumer space with many different lenders specialising in different types of clients.

So basically, consumers need more proof of income, but have more options.

5: Both clients and partners have awarded you some fantastic feedback, what do you attribute this to?

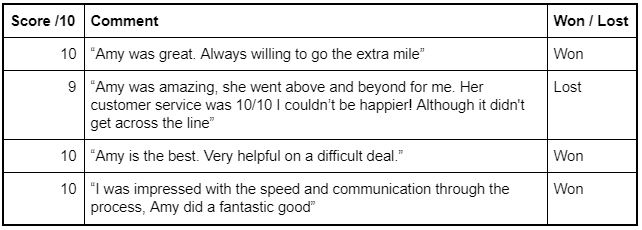

(Amy’s recent NPS records speak for themselves)

(Amy’s recent NPS records speak for themselves)

Consistency is the biggest thing that our partners and clients appreciate about the standard of work I deliver.

I have consistent turnaround times, my personality is consistent and even if I am having an off day, I always try to ‘smile’ on the phone – that means being happy. I also enjoy helping people, that’s what we’re here for. If you don’t enjoy that, it reflects on your own standard of work.

One of the things that has always stuck with me from one of my first training sessions on the phone is you can hear a smile, I always smile while talking to our partners.

So, to get that high NPS we all want, smile on the phone.

6: As you mentioned, consistency is hugely important, especially for referrals and repeat business. How can our partners maintain a consistent high level of customer service?

This is funny coming off my last answer. I find the key to consistency is treating everyone the same, no matter if they have bad credit, are Centrelink only or if they have multiple properties and millions in equity.

If you treat every deal as you would a “prime client”, all clients will get the same amount of excellent service from you.

7: You’re well known for your amazing ability to build a rapport with clients. Tell us some secrets.

Be real! I’m real with all my partners that I work with and I like to think that most of them know a little bit about me.

I’m happy, bubbly and I love a chat and this is how I build that rapport. It’s something so important in our industry.

I used to also do the same when I worked with clients directly. When you are dealing with someone’s financial situation, whether it be good or bad, you need to build trust.

Giving a part of yourself, having a laugh or being empathic is how all solid relationships are built.

8: Finally, complete this sentence: Consumer asset finance clients want…

…the best possible loan for their financial needs delivered with a smile.

Stay tuned. We’ll be hearing a lot more from Amy in the near future.

Other coffee chats

- Relationship Manager, Chris Tilley, talks us through strategies on providing A1 service

- Support Team Leader, Elliot Bloem, goes over how to get it right the first time (thus, saving time)

- Chief Operating Officer, Tim Wells, discusses key issues like how to avoid losing clients, COVID recovery data and BID.