Trucks and heavy vehicles are a sizable investment. In fact, nearly 330,000 people would agree – that’s the number of registered trucks on Australian roads.

Following on from, Assets in the spotlight – Motor Vehicles (Consumer), Nodifi’s second guide in the ‘Assets in the Spotlight’ series focuses on truck finance.

Key Takeaways:

- Truck loans are often listed as chattel mortgages or lease agreements

- Rates are calculated similarly to other forms of asset finance

- Most commercial truck finance includes vehicles valued up to $500,000

- New, used, short and long haul trucks can be financed

- Different types of client profiles require different types of financial documents

Truck loans in a nutshell

Truck loans are different financial products from consumer asset finance products. However, they do share some similarities.

Truck loans often fall in two categories:

Chattel mortgages

This is where a borrower uses funds from a lender to purchase the truck and they make repayments on a monthly basis back to the lender. The truck is used for business purposes and purchased under an ABN. The truck is registered to the borrower. This is the most common way of lending in today’s market.

- The truck is listed as an asset under the borrower’s business.

Lease

This is where the lender ‘owns’ the truck and the borrower pays a lease on the vehicle with the intention of owning it when all payments are made. The repayments include all lease setup costs. At the end of a lease, the borrower has the option to purchase the truck for an agreed amount, or hands the truck back to the lender (lease company). This is less popular in today’s market.

- The truck is not listed as an asset under the borrower’s business.

It’s very rare to find a private consumer purchasing a truck with cash.

Firstly, the all important rates

As with all types of finance, the better the borrower profile, the more competitive the rates. Commercial borrowers with excellent credit reports and profitable accounting records with a long and established history of trading have access to rates from 3.7%

Nodifi has access to a range of lenders who can often tailor loan packages to suit almost all clients and asset ages.

As trucks typically have high mileage, lenders may require inspection reports to confirm the condition.

Common rates per client profile:

- New truck / property owner / long-term ABN and GST / excellent credit score (700+): 2.85 – 3.1%

- 1 – 4 year-old truck / property owner / under 3 year ABN and GST / average credit score (550): 4 – 9%

- Truck over 4 years old / non property owner / minimal trading history / low credit score (400 and below): 10%+

* How long does trading history have to be? This depends on other profile factors such as credit history.

How much can my client borrow?

Like rates, your client’s ability to pay the loan off within the loan term is taken into account.

Most lenders require a minimum loan amount of $5,000 and stretch to a maximum lend of $500,000.

Nodifi understands that both trucks and borrower requirements vary hugely – a borrower may only need a small amount to complete a transaction. On the other hand, your client may be purchasing a new prime mover and trailer.

New vs used

The market for used trucks is huge in Australia. Many borrowers are attracted to the lower prices and appreciate the (likely) regular and documented service history that most commercial vehicles have.

Certain lenders specialise in prime movers, trailers, and long or short haul operations.

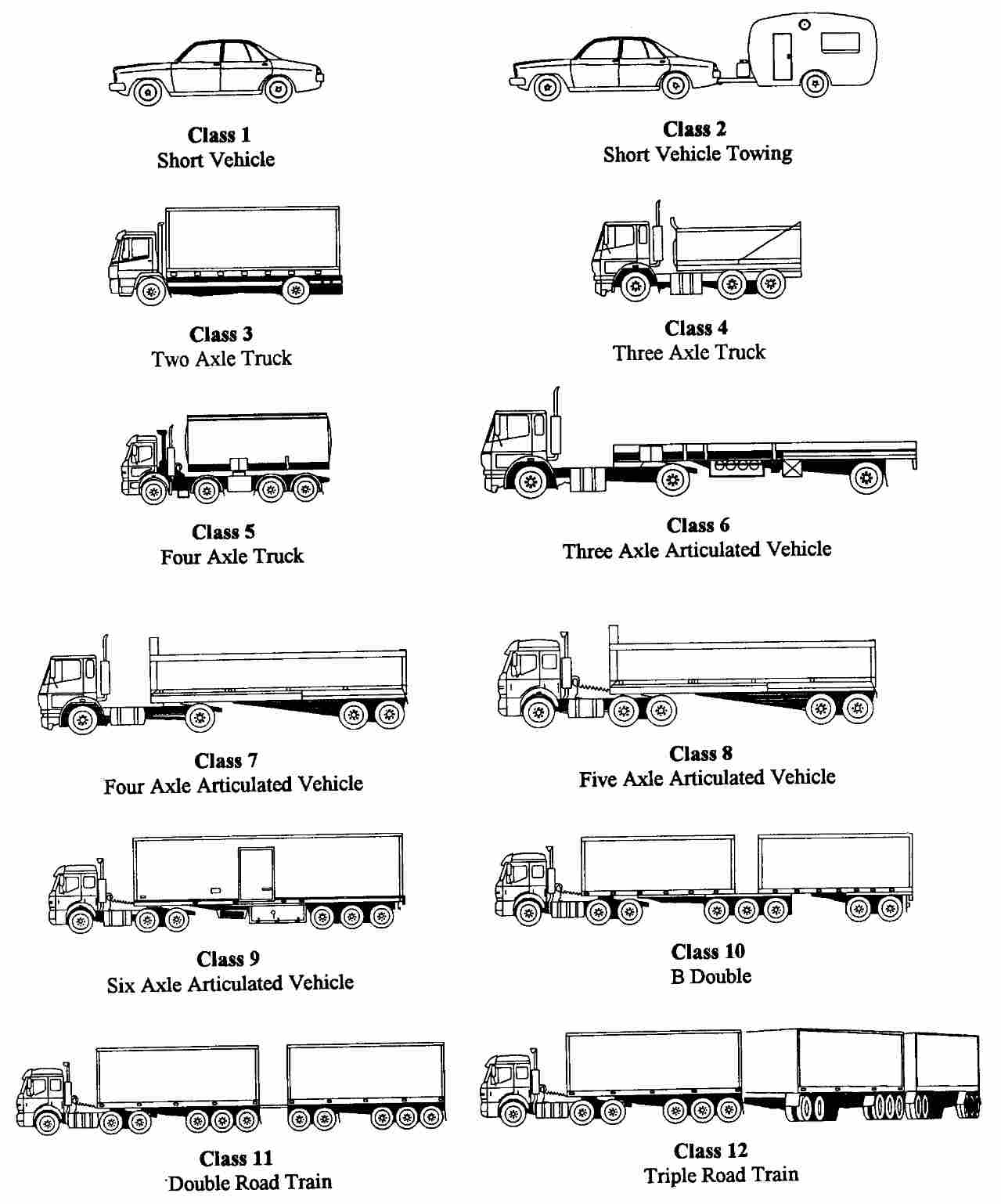

Trucks are classed per number axles and trailer type. Australian vehicle classes:

(source: austroads.com.au)

Things to be aware of:

- Long haul vs short haul trucks

Some lenders specialise in long-haul trucks that criss-cross the highways of Australia. These may require additional documentation. Other lenders focus on short-haul trucks which usually state or even city based.

- Average mileage for the age of the truck

Used trucks understandably have huge mileage. Make sure your client knows the odometer reading as additional inspections may be required.

- Truck pricing

Truck prices vary hugely by brand, age, mileage, condition and of course, load capacity.

Documents and information

If your client is interested in a truck loan, they’ll likely be concerned about what documentation is needed.

Other than typical loan documents such as identification, signed privacy consent and ABN details, truck loans can be surprisingly simple.

When it comes to documentation, truck loans, like many commercial financial products, are split into three categories:

- Full-Doc

All financial documents are required to prove income and serviceability. BAS statements, bank statements and ABN and GST registration. The loan amount and loan term are determined by these documents. - Low-Doc

Some financial documentation is required such as bank statements and payslips. Who for? Clients with 12 months or more trading under ABN and a clean credit history. - No-Doc

No financial documents are required by the lender to assess the deal.

Different lenders have different qualifying criteria for the above financial products. Low-doc loans are generally the most popular. If you’re not sure where your client sits, give your Nodifi representative a call.

Truck finance in summary

Trucks make up a sizable portion of our partner’s portfolios. Nodifi is committed to making that portion grow. If you’re unsure what kind of finance package and its details apply to your client, talk to your Nodifi representative.

The Nodifi team is here to help. Find out how you can offer your clients fast and fuss-less truck finance today by submitting a scenario.